Hello everyone, I hope everyone is safe from this latest wave of selling pressure to start 2022. The Federal Reserve has indicated its intent to hike rates throughout the year and continue tapering off monetary stimulus. That coupled with less than stellar earnings could be just the right mix for many sectors to continue their march lower. Only time will tell…

Having said that, lets turn our attention to the ThinkorSwim Probability Cone. This indicator is one of my favorites and it makes seeing the probability of price reaching a particular level ridiculously easy.

Probability Cone Post Contents

- What is the ThinkorSwim Probability Cone?

- How To apply the Probability Cone to ThinkorSwim Charts

- Common Probability Cone usage

- How I trade using the ThinkorSwim Probability Cone

What is the ThinkorSwim Probability Cone?

In short, the probability cone provides a market technician a visual representation of future theoretical prices. The probability cone is essentially a standard deviation bell curve that’s been flipped vertically to allow for easier viewing on a chart. To those that may not know, a standard deviation is the measure of price dispersion around a mean price. In this case, around the current market price.

To avoid a deep dive into standard deviations, just know that 68% of the time price will fall within the probability cone on a future date. That of course, results in a 32% possibility price will fall somewhere outside the cone on a future date. Furthermore, the cone is calculated using current volatility for accuracy. Afterall, it wouldn’t make sense or even slightly benefit us to draw a probability cone that didn’t account for extremely volatile market conditions.

In all, the probability cone makes visualizing the standard deviation curve easier and faster. This lends itself well to any trader that’s been in this game long enough to know, not every trade will be a winner. Additionally, a trading plan that maintains a 68% win rate and proper money management likely means never working 9-5 again. But I’ll save that topic for another time. 😉

For anyone interested to continue learning about ThinkorSwim’s ProbabilityOfExpiringCone, here is a post from TickerTape.com.

How to apply the Probability Cone to ThinkorSwim Charts

Start by selecting the chart tab along the top ribbon.

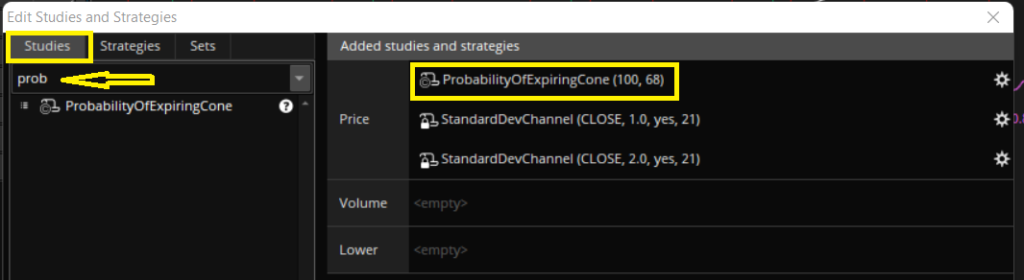

Then select the beaker icon to edit studies.

Once Selected, locate the studies tab to the left and type “probabilityofexpiringcone” just below. The indicator will populate without needing to type the entire string. Double click to add to the chart. Click apply. Click ok.

You should now see the probability cone displayed in magenta based on the last market price of the asset you’re currently viewing. However, please note, the cone can only be displayed on daily, weekly, or monthly charts. Thus, without coding a custom variant of the probability cone it wouldn’t be useable for intraday charts.

Common Probability Cone Usage

Typically, and as mentioned above, traders use probability to determine the chance price finishes at, below, or above a certain price level in the future. For options traders, this is of tremendous value. Since, many options strategies can be constructed to profit if those levels hold true. Additionally, as we learned above, its possible for those levels to be true 68% of the time. In theory of course, reality may be something else entirely but let’s not traverse that rabbit hole today.

Generally options traders use the probability cone to identify strike prices for a specific strategy. For example, suppose I was bullish on Apple (AAPL) (shown below) and I wanted to initiate a bull put spread. Using the probability cone and the knowledge that 68% of the time price falls within the cone. It could be reasonably assumed that price has a lesser chance of breaching the short strike if placed just below the band at the desired expiration.

While nothing in the market is fail safe, constructing trades in this manner does put probability in your favor. In short, not only does the probability cone indicate potential price levels, it’s also useful to determine levels price won’t reach. Additionally, traders use the cone to determine stop loss, breakeven, or profit target levels. Moreover, these use cases are really the tip of the iceberg when it comes to probability cone usefulness.

How I trade using the Probability Cone

As mentioned above, I use the probability cone to determine a range price is likely to stay within as well as where price likely won’t go. As an options trader, I aim to maintain a 50-60% win rate across a specific strategy. This advantage creates enough profitability to cover commission costs and maintain a small but consistent profit. When I notice my win rate has dipped below the 50% level for any extended period of time I take a break from trading. If after that break I return to find my win rate is still below 50% I start re-evaluating my current plan.

Let’s consider this hypothetical scenario.

Assume I’ve decided to trade only bullish put spreads. In addition to the probability cone I’ll also use a standard deviation channel to identify areas of price over extension. I’ll start with an account balance of $1,000, only trade $1 wide spreads, and I’ll maintain a minimum 50/50 risk/reward profile for each trade. That data could look similar to the following;

| Ticker | Profit/loss | Commission | Cashflow |

| GLD | $50 | -$3.00 | $1047 |

| SPY | -$50 | -$3.00 | $994 |

| QQQ | $50 | -$3.00 | $1041 |

| QQQ | -$50 | -$3.00 | $988 |

| DIA | $50 | -$3.00 | $1035 |

| TLT | $50 | -$3.00 | $1082 |

| QQQ | $50 | -$3.00 | $1129 |

| SPY | -$50 | -$3.00 | $1076 |

| GLD | -$50 | -$3.00 | $1023 |

| GLD | $50 | -$3.00 | $1070 |

| TLT | $50 | -$3.00 | $1117 |

| TLT | -$50 | -$3.00 | $1064 |

| TLT | -$50 | -$3.00 | $1011 |

| GLD | $50 | -$3.00 | $1058 |

| SPY | $50 | -$3.00 | $1105 |

| SPY | -$50 | -$3.00 | $1052 |

| QQQ | $50 | -$3.00 | $1099 |

| SPY | -$50 | -$3.00 | $1046 |

| TLT | $50 | -$3.00 | $1093 |

| DIA | $50 | -$3.00 | $1140 |

| GLD | -$50 | -$3.00 | $1087 |

| GLD | $50 | -$3.00 | $1134 |

| SPY | $50 | -$3.00 | $1181 |

| TLT | -$50 | -$3.00 | $1128 |

| TOTAL | $200 | -$72.00 | $1,128 |

Probability Cone Performance – Hypothetical Results

| Wins | Losses | Total | Win Percentage | Total Return | Total Risk | ROR | ROC |

| 14 | 10 | 24 | 58% | $128 | $1200 | 10.6% | 12.8% |

Using this small sample size and the above mentioned criteria details the true benefit to trading using probabilities. Specifically, trading using the ThinkorSwim probability cone. With it, a trader has reliable evidence and therefore conviction an assumption regarding future price is accurate. And in this uncertain, volatile market, what more could we really ask for?

In closing, I do hope this post was helpful to those that may ultimately read it and that you also find a benefit from the use of probability cones in your own trading. If I can ever be of assistance please feel free to reach out to me in the comments or at Jeff@OptionBoxer.com.

God Bless,

Jeff

thank you for the detailed study of the indicator. question is how close this study comes around option expiration expected to move on either side.

Hello Ja,

If I understand your question correctly it seems you would need to custom code a version of the probability cone that would be usable on intraday charts. The built in version on TOS is only usable on the daily, weekly, or monthly charts. That said, you could look at the expected move to determine a given day’s range. Here is a link to a youtube video that discusses expected move.

https://youtu.be/7sYcbZD9Gps

God bless,

Jeff